Streamline toast payroll Your Business Finances with Toast Payroll

Introduction to Toast Payroll

In the fast-paced restaurant industry, managing payroll can be a daunting task. Toast Payroll is a comprehensive payroll and team management solution designed to simplify and streamline the payroll process for restaurants and food service businesses. It integrates seamlessly with the Toast point-of-sale (POS) system, providing a unified platform for managing wages, employee schedules, tax compliance, and more. With increasing labor regulations and the need for accurate reporting, having a reliable payroll system is essential for operational efficiency and legal compliance.

Payroll systems are the backbone of modern business operations, especially in industries with high employee turnover and complex wage structures. Toast Payroll is designed specifically to cater to the unique needs of restaurants, offering features that address challenges like tip management, overtime calculations, and compliance with wage laws. By automating these processes, businesses can reduce errors, save time, and focus on delivering excellent customer experiences. As more businesses recognize the importance of efficient payroll management, solutions like Toast Payroll are becoming indispensable.

Many restaurants are choosing Toast Payroll due to its intuitive interface and robust features. It simplifies payroll by integrating time tracking, automating tax filings, and providing real-time reporting. This helps business owners maintain compliance and transparency while reducing administrative burdens. For growing businesses, Toast Payroll scales easily, accommodating the complexities of managing a larger workforce. By adopting a dedicated payroll solution, restaurants can improve accuracy, streamline operations, and enhance employee satisfaction.

Key Features of Toast Payroll

Toast Payroll is packed with advanced features that make payroll processing efficient and error-free. One of its standout features is automated payroll processing. This allows businesses to calculate wages accurately, accounting for hourly rates, overtime, and tips. Automated payroll reduces manual calculations and minimizes human error, ensuring employees are paid accurately and on time. For businesses that manage a large staff, this feature is a game-changer in terms of time savings and reliability.

Another valuable feature is integrated time tracking and scheduling. With Toast Payroll, employee hours are automatically tracked through the Toast POS system, eliminating the need for manual input. This integration ensures that payroll data reflects actual working hours, reducing discrepancies and streamlining payroll audits. Managers can also schedule shifts, track attendance, and monitor labor costs in real-time. This level of integration helps businesses maintain accurate records and better manage labor expenses.

Tax compliance and reporting are critical components of payroll management, and Toast Payroll excels in this area. The system automatically calculates and files federal, state, and local taxes, ensuring compliance with current regulations. It also generates detailed reports that simplify audits and end-of-year tax filings. This feature not only saves time but also reduces the risk of penalties due to incorrect tax filings. Additionally, employees can access their pay stubs and tax forms through the self-service portal, improving transparency and communication.

Advantages of Using Toast Payroll

One of the primary advantages of using Toast Payroll is improved accuracy and reduced errors. Manual payroll calculations are prone to mistakes, which can lead to overpayments, underpayments, and compliance issues. Toast Payroll automates these processes, ensuring accurate calculations based on actual working hours, tips, and overtime. This precision reduces administrative burdens and provides peace of mind for both employers and employees.

Time-saving automation is another major benefit. With Toast Payroll, repetitive tasks like wage calculation, tax filing, and report generation are automated, freeing up time for managers to focus on other aspects of the business. This automation is particularly beneficial for restaurants with high staff turnover, as it reduces the time spent onboarding new employees and managing complex wage structures. Businesses can also set up recurring payroll schedules, minimizing manual intervention.

Seamless integration with the Toast POS system enhances operational efficiency. Data flows seamlessly between the POS and payroll systems, ensuring that employee hours and tips are accurately captured. This integration reduces the need for manual data entry, minimizes discrepancies, and provides real-time insights into labor costs. By linking payroll with other operational systems, businesses gain a comprehensive view of their financial health.

Additionally, Toast Payroll enhances employee satisfaction by providing a self-service portal. Employees can view their pay stubs, update personal information, and access tax documents anytime. This transparency fosters trust and reduces payroll-related inquiries. Businesses that prioritize accurate and timely payroll processing are more likely to retain employees and maintain a positive work environment.

Setting Up and Implementing Toast Payroll

Setting up Toast Payroll is a straightforward process that begins with gathering essential business and employee information. Business owners need to provide details like tax identification numbers, bank account information for direct deposits, and employee records. Toast offers step-by-step guidance to ensure a smooth implementation. The platform also allows businesses to customize payroll settings to match their specific needs, such as pay frequency, overtime rules, and tip reporting.

Migrating from other payroll systems is made easier with Toast’s dedicated support team. Businesses can import existing employee data and payroll records, reducing the hassle of starting from scratch. This migration process minimizes downtime and ensures continuity in payroll operations. Toast also provides comprehensive training resources to help staff understand and utilize the platform effectively. Investing time in proper setup and training ensures that businesses can fully leverage Toast Payroll’s capabilities.

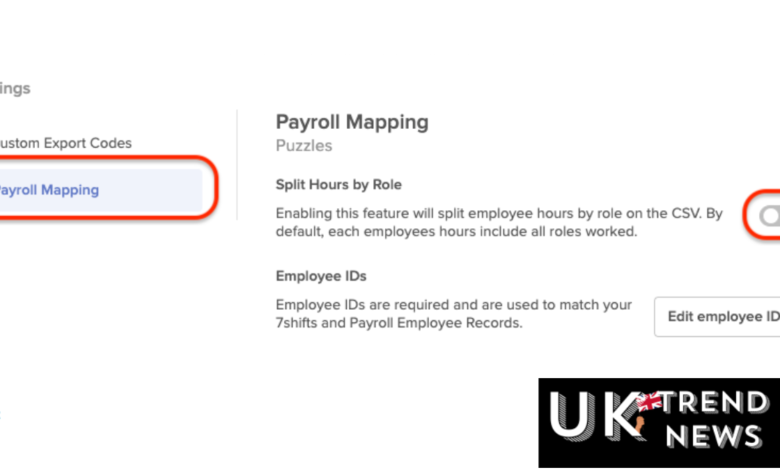

Customization is a key advantage of Toast Payroll. Businesses can tailor payroll processes to reflect their operational structure and compliance requirements. For example, restaurants can configure tip pooling, calculate overtime accurately, and accommodate different pay structures. This flexibility allows businesses to manage payroll efficiently while adhering to legal standards. Regularly updating employee records and auditing payroll data further enhances accuracy and compliance.

Conclusion

Toast Payroll is a powerful solution designed to simplify payroll management for restaurants and food service businesses. Its automated features, seamless integration with the Toast POS system, and robust compliance tools make it an invaluable asset for business owners. By streamlining payroll processes, Toast Payroll reduces errors, saves time, and enhances employee satisfaction. Businesses can focus on delivering exceptional customer experiences while ensuring accurate and compliant payroll management.

For restaurants seeking an efficient and reliable payroll solution, Toast Payroll offers a comprehensive platform that meets industry-specific needs. Its user-friendly interface, customization options, and dedicated support empower businesses to manage payroll with confidence. As the restaurant industry evolves, adopting advanced payroll systems like Toast Payroll is essential for staying competitive and maintaining operational excellence.

FAQs

- What is Toast Payroll, and how does it work?

Toast Payroll is a payroll management system integrated with the Toast POS platform. It automates wage calculation, tax compliance, and employee scheduling, providing an all-in-one solution for restaurant payroll needs. - Is Toast Payroll suitable for small businesses?

Yes, Toast Payroll is ideal for small to medium-sized restaurants. It offers scalable features that accommodate businesses of various sizes while simplifying payroll and compliance tasks. - Can I integrate Toast Payroll with other accounting software?

While Toast Payroll is primarily designed to integrate seamlessly with Toast POS, it also supports data export capabilities that allow businesses to synchronize payroll information with other accounting platforms. - How secure is the data on Toast Payroll?

Toast Payroll prioritizes data security through encryption, secure access controls, and compliance with industry-standard data protection regulations, ensuring employee and business information remains safe. - What kind of customer support does Toast offer?

Toast provides comprehensive customer support, including online resources, dedicated onboarding specialists, and 24/7 assistance to help businesses manage payroll effectively. - How long does it take to implement Toast Payroll?

Implementation typically takes a few weeks, depending on the business size and complexity. Toast offers step-by-step guidance and support to ensure a smooth transition. - Are there additional fees for using Toast Payroll?

Toast Payroll operates on a subscription model. Additional fees may apply based on the number of employees and specific features used, but transparent pricing is provided upfront. - Can employees access their own payroll information?

Yes, the employee self-service portal allows staff to view pay stubs, update personal information, and access tax documents anytime. - What happens if there is an error in the payroll?

Toast Payroll provides tools for identifying and correcting errors promptly. Businesses can also access support to resolve complex payroll discrepancies. - How often is Toast Payroll updated to reflect legal changes?

Toast Payroll is regularly updated to comply with federal, state, and local labor laws, ensuring businesses remain compliant with the latest regulations.